In today’s intricate financial landscape, uncovering Ultimate Beneficial Ownership (UBO) is more crucial than ever. UBO analysis involves diving into the intricate web of ownership structures, often extending through multiple levels and involving numerous entities. Picture a scenario where a person owns a company, which in turn owns two other companies, and each of those owns two more. Add to this mix various trusts and assets linked to the beneficial ownership, and you have a complex ownership chain or tree. The ultimate goal of UBO analysis is to pinpoint who truly owns these assets and businesses hidden within these labyrinthine structures. Unfortunately, fraudsters have become adept at using these complex structures to conceal their assets. One of the simplest methods involves non-direct ownership through family members, such as placing assets in the names of spouses or children. However, the schemes have evolved to include elaborate networks of companies, trusts, and super fund holdings, specifically designed to obscure true ownership. These structures are not only prevalent in tax avoidance schemes but are also increasingly utilized in organized crime. Traditional analysis techniques struggle to keep pace with this escalating complexity, as the intricate structures are too challenging to analyze and retrieve data from effectively.

The Importance of UBO Analysis

Why is UBO analysis so vital? There are numerous critical use cases across both public and private sectors. One significant area is criminal asset confiscation. In some jurisdictions, law enforcement agencies have the authority to seize assets from individuals involved in financial crimes. However, these assets, which can include real estate, vehicles, planes, and boats, are often not directly tied to the criminals. Instead, they are hidden within complex ownership structures. UBO analysis can reveal these hidden linkages, enabling law enforcement to confiscate the assets effectively. Another critical area is tax evasion. Understanding company structures and identifying the ultimate beneficiaries are essential for determining tax liabilities. Additionally, in the realm of supply chain risk management, complex ownership structures are often used to bypass sanctions and obscure the real operators and financiers of certain companies. Both public and private sectors need to understand these hidden connections to mitigate risks effectively.

The Limitations of Traditional Analysis Techniques

Traditional analysis techniques fall short in dealing with the growing complexity of UBO investigations. When ownership data is stored in traditional tabular formats, analysts are forced to manually draw connections and traversals from one entity to another. This manual process is not only time-consuming but also prone to errors, making it nearly impossible to keep up with the depth of analysis required to identify complex UBO trees.

The Power of Graph Databases in UBO Analysis

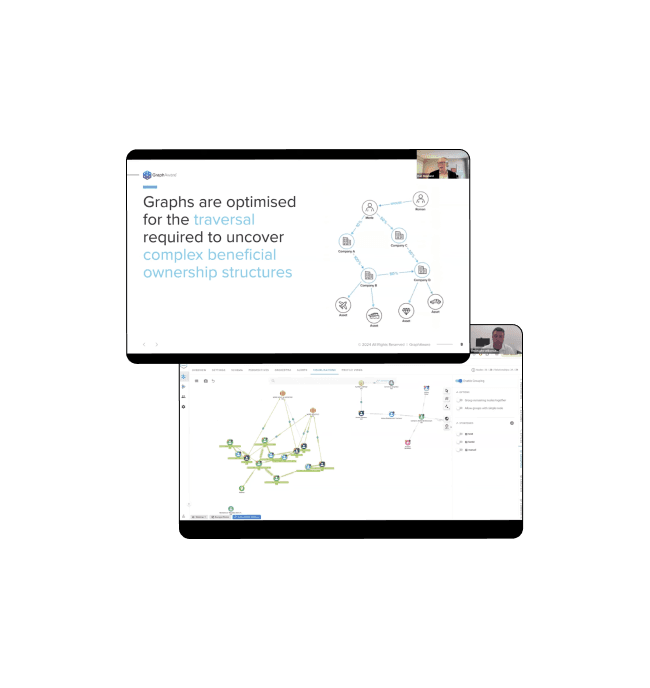

This is where graph databases and advanced solutions like those offered by GraphAware come into play. Graph databases are specifically designed to handle the complexities of UBO analysis. They excel at traversing and analyzing linkages between entities, making them ideal for uncovering hidden ownership structures. Graphs are optimized for deep traversals, enabling analysts to explore complex ownership trees and the assets tied to them efficiently. By leveraging graph analytics, organizations can automate the discovery of intricate relationships and ownerships, providing a clear and comprehensive view of UBO structures. In conclusion, as ownership structures continue to grow in complexity, the need for advanced analytical tools becomes increasingly evident. Graph databases offer a robust solution, enabling effective UBO analysis and helping to combat financial crimes, tax evasion, and supply chain risks. By embracing graph analytics, organizations can unlock new capabilities in identifying and understanding the ultimate beneficial owners hidden within intricate webs of ownership.

Unlocking Complex Ultimate Beneficial Ownership Investigation