The Power of Graph Technologies for Uncovering Business Connections and Ultimate Beneficial Ownership Chains

Company Ownership Data is Rapidly Expanding

The modern business landscape is witnessing an unprecedented expansion in company ownership data. Today, setting up a company is relatively cheap and easy, whether for legitimate entrepreneurial endeavours or more opaque financial purposes. Similarly, trusts and other financial structures can be created with ease, often forming intricate chains of beneficiaries that obscure the ultimate ownership and control of assets.

This has led to an explosion in the use of financial structures over the past decade:

- In the financial year ending (FYE) 2023, there were 801,006 company incorporations in the UK, marking a 6.4% increase compared with the previous year. (Source)

- By the end of FYE 2023, over 35% of all companies on the total register were between one and four years old. (Source)

- In 2024, over 29% of new overseas company registrations originated in the Channel Islands. (Source)

While these statistics do not inherently indicate wrongdoing—company formations are often a sign of economic growth and innovation—the Panama Papers and Paradise Papers have demonstrated how these structures can also be used to obscure illicit activities.

The Importance of Understanding Company Structures

Identifying the ultimate beneficial owners (UBOs) of companies is critical for fostering a fair and transparent business environment. Consider the following areas where company ownership transparency is essential:

- Supply Chains – Understanding who truly owns suppliers helps companies assess risks, ensure ethical sourcing, and avoid dealings with sanctioned entities.

- Organised Crime & Criminal Asset Confiscation – Law enforcement agencies need to trace ownership to seize criminal proceeds.

- Undeclared Wealth & Tax Evasion – Tax authorities seek to uncover hidden wealth stored in complex corporate structures.

- Sanction Enforcement – Governments and regulators need to ensure that sanctioned individuals or entities are not circumventing restrictions using layered company structures.

Streamlining Criminal Assets Confiscation

Read The Case Study

The Limitations of Traditional Analysis Techniques

Traditional data analysis methods struggle with the complexity of ownership relationships. Company ownership data is often stored in tabular formats, which makes it difficult to untangle the intricate web of relationships between individuals, trusts, companies, and other financial entities.

Imagine being handed a large spreadsheet of ownership data and tasked with manually drawing the connections—it would be a tedious and error-prone process. Moreover, even advanced computational approaches in traditional databases struggle with deeply nested ownership structures.

How Graph Technologies Unlock Insights

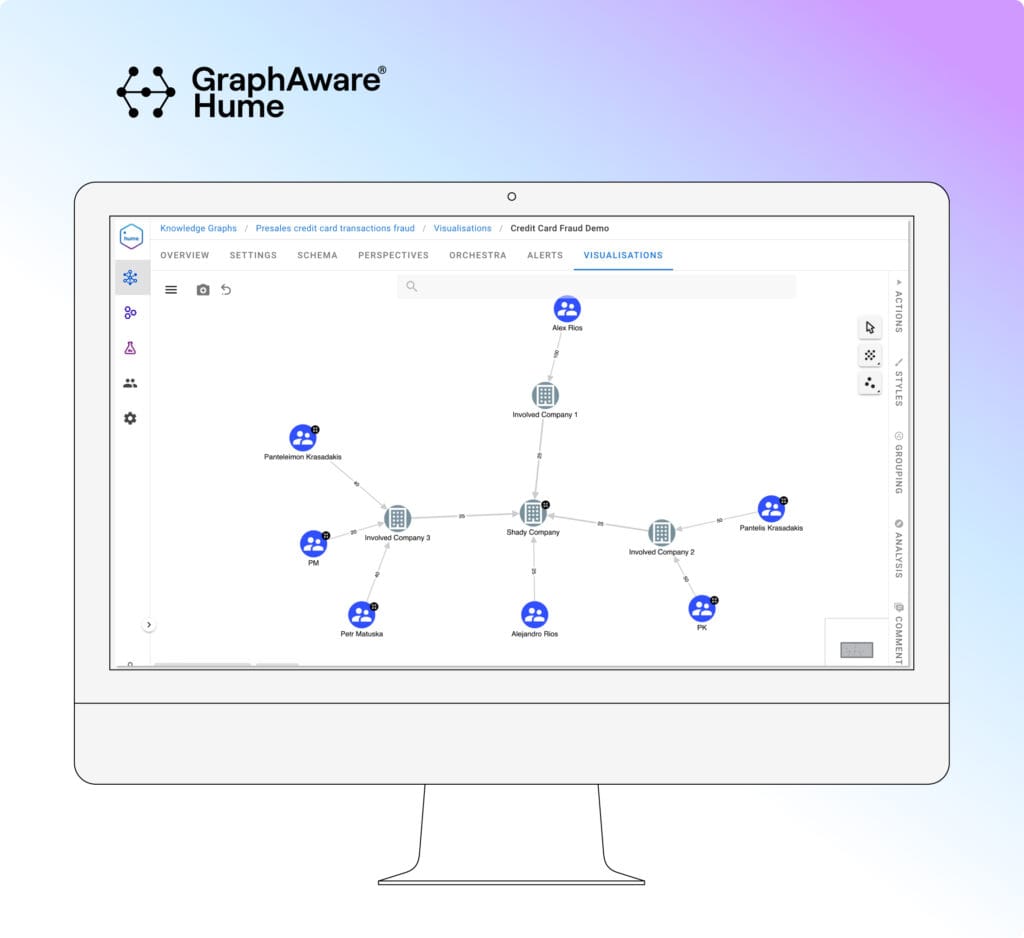

This is where graphs excel. Unlike traditional tools, which require complex and expensive operations to map ownership chains, graph technologies store, query, analyse, and visualise entities and their relationships as a network (graph), naturally reflecting real-world connections. Instead of manually creating link charts, the data is already stored in a connected format.

Analysts can simply query the graph to reveal hidden connections, track indirect ownership paths, and identify ultimate beneficial owners with unparalleled efficiency.

Conclusion

As company structures grow increasingly complex, understanding business connections and ultimate beneficial ownership is more important than ever. Graph technologies provide an intuitive, scalable, and powerful way to uncover hidden relationships that would be nearly impossible to detect using traditional methods.

Whether for compliance, due diligence, or investigative purposes, leveraging graphs can transform how businesses, regulators, and enforcement agencies navigate the modern corporate landscape.

Case Study: The Abuse of Company Structures

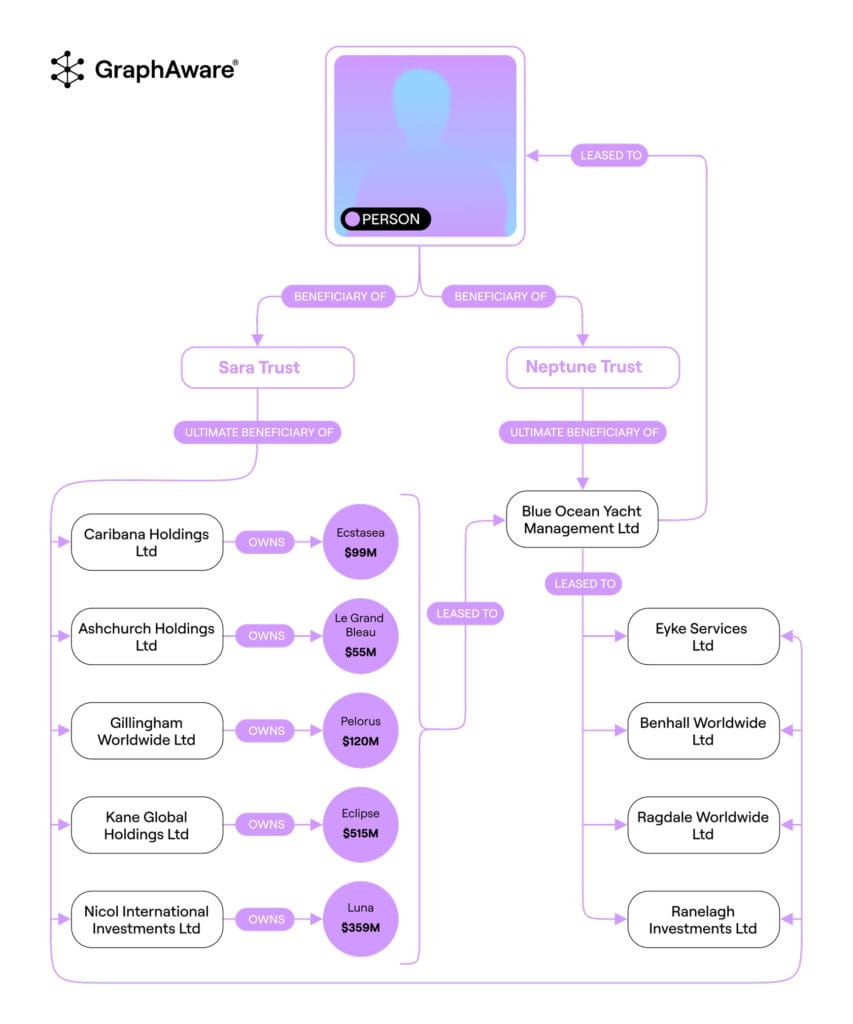

Russia’s most famous oligarch, has recently had his financial dealings widely scrutinised as an example of how corporate structures can obscure ownership, protect assets, and complicate financial investigations. The Cyprus Confidential files suggest he used offshore trusts and shell companies to distance himself from high-value assets, making it harder for authorities to enforce tax laws and financial restrictions. An example illustration of this, referred to as ‘The Blue Ocean Scheme’, is displayed below. His case raises concerns about how complex legal arrangements allow wealth to move through opaque networks, limiting accountability.

Furthermore, investigations indicate that his ownership structures were restructured just before sanctions took effect, potentially complicating enforcement efforts. His financial links to political figures further highlight how company structures may be used to shield wealth and influence. The challenges authorities face in tracking and restricting such assets reflect a broader issue—where legal ownership and real control are deliberately separated, making Ultimate Beneficial Ownership investigations essential in uncovering financial secrecy.

GraphAware

GraphAware brings together leading experts in graphs and data science to develop a connected data analytics platform, GraphAware Hume, helping government agencies across three continents find truth in data.

Join the GraphAware team at the AUS Government Data Summit in Canberra from April 1–3, 2025! Don’t miss our presentation, Rethinking Ultimate Beneficial Ownership Investigations for the Future, and visit us at our booth #22 to see graph technology in action. We’d love to meet you!